Demand Deposit Vs Time Deposit

There is no fixed time period involved in the case of a demand deposit. The most common types of demand deposits are.

/dotdash-what-difference-between-demand-deposit-and-term-deposit-Final-829288def6244955b02bd4aff6152618.jpg)

The Difference Between Term Deposit Vs Demand Deposit

Time deposit is the common name and time deposit can also be termed as term deposit Time deposits are accepted for certain period Demand deposits.

. The difference between a demand deposit account or checking account and a negotiable order of withdrawal account. A demand deposit account is just a different term for a checking account. The money must remain in.

Answer 1 of 5. Demand deposit noun a deposit subject to withdrawal at the demand of the depositor without prior notice. A time deposit is an interest-bearing bank account that has a pre-set date of maturity.

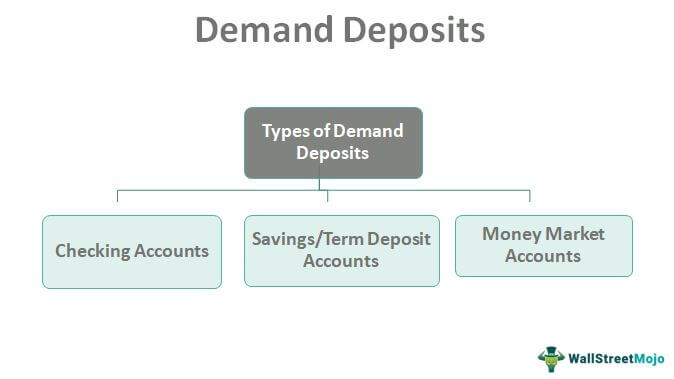

Time deposit accounts earn higher interest rates than demand deposits. Basically a DDA allows funds to be accessed anytime while a term deposit accountalso known as a time deposit accountrestricts access to funds for a predetermined. Within this category there are three main types of demand deposits.

Up to 24 cash back Demand Deposit Vs Time Deposit. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Time deposit is access.

Time Deposit Account A demand deposit account such as a checking or savings account is not the same as a time deposit account. The depositor will typically use demand deposit funds to. Demand Deposit Account vs.

Time Period Time deposits are deposited in bank for a fixed period of time Usually 1 year to 5 years whereas there is no fix time period involved in case of demand. A deposit of money that can be withdrawn without prior notice. Your demand deposit account provides flexible access not only through cheques but also debit cards.

You may be charged a fee if your demand account balance dips below a certain level or for another. Bank accounts arent all alike and its important to note how demand deposit accounts differ from time deposit accounts. Time deposit noun a deposit that can be withdrawn by the depositor only after.

The key difference between demand deposit vs. Time deposits are deposited in the bank for a fixed period of time usually 1 year to 5 years. A demand deposit is a bank account that allows you to withdraw funds at any time without having to notify the bank first.

1 checking accounts 2 savings accounts 3 money market accounts. A demand deposit account DDA is an account with a financial institution that allows you to access your money at any time without giving prior notice to that institution. You find its optimum efficacy while withdrawing funds at an ATM paying bills and e.

Also referred to as term deposit accounts time. A demand deposit is money deposited into a bank account with funds that can be withdrawn on-demand at any time. Demand deposits or non-confidential funds consist of funds.

A certificate of deposit CD is the best-known example. With demand deposit accounts you generally access your money at any time without paying a. Learn more about the benefits of.

/dotdash-what-difference-between-demand-deposit-and-term-deposit-Final-829288def6244955b02bd4aff6152618.jpg)

The Difference Between Term Deposit Vs Demand Deposit

Demand Deposits Meaning Example Top 3 Types Of Demand Deposits

Demand Deposit Vs Time Deposit What S The Difference Forbes Advisor

No comments for "Demand Deposit Vs Time Deposit"

Post a Comment